The NEW approach to your mortgage.

At NEO Home Loans, we empower you with financial literacy and help guide your journey to financial freedom.

Schedule your dreams & goals call

Michael Dean

Branch Leader | NMLS# 1119943

When you purchase a home, you’re placing a lot of trust in your loan officer. While our interaction may last only 30 days or so, I’ve dedicated my life to making that process smooth and successful. As a thorough and calculated tactician, I aim to build lifetime relationships with my clients, and they know they can count on me.

I’ve lived in Central Florida since birth and work in the heart of Downtown Orlando as a branch manager for CrossCountry Mortgage. Being a local lender means my reputation is on the line with every transaction. As part of America’s #1 Retail Mortgage Lender, I’ve helped thousands of families in the Central Florida community achieve homeownership, and I’d be honored to do the same for you.

I’m proud to have been ranked on the Scotsman Guide Top Originators 2021, 2022, 2023, 2024, and 2025 list and included in Experience.com's list of America’s Top 50 Loan Officers for Customer Satisfaction.

The NEO Experience

Being a successful homeowner is so much more than just buying a home and making your mortgage payment. The NEO Experience will make sure your home will always be a powerful tool that can help you achieve your financial goals, create generational wealth, and enjoy a secure retirement.

OUR PROCESS

Step 1

Discovery

We need to learn about you so we can understand your financial situation and long-term goals before we prescribe a mortgage strategy.

Step 2

Strategy

We will analyze mortgage options with the lowest cost and greatest prosperity potential for you and your family, then present you with a Total Cost Analysis - a digital and easy-to-read breakdown of your mortgage options.

Step 3

Execution

We create a flawless home loan experience for you. If you are in a highly competitive market, we will position you to close your loan as quickly as possible. If you need more time to prepare, we will continue to advise you on your financial situation until you are ready to buy or refinance your home.

Step 4

Wealth Maximization

Your life and the real estate market where you live can change rapidly. Even after you are in your new home, we will continue to manage your mortgage and help you maximize your wealth.

The closing of your loan is just the start of our relationship.

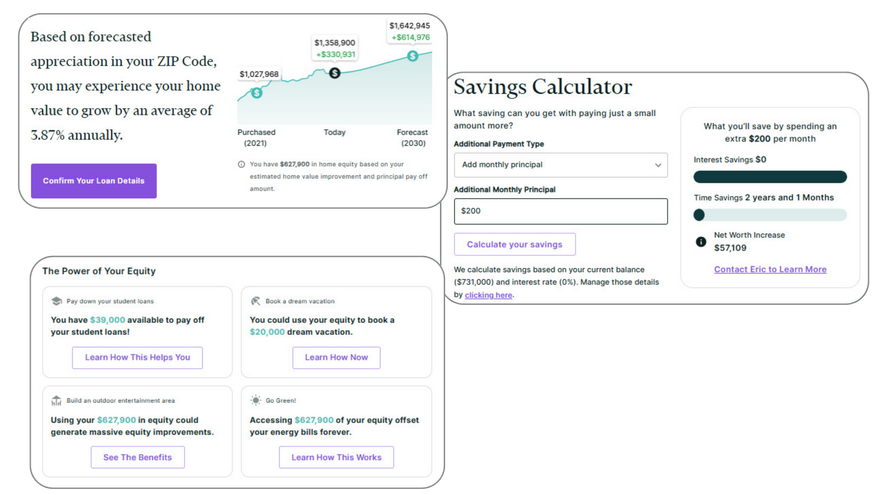

Stay informed about the value of your home!

Our monthly report offers an intuitive financial dashboard, tailored to enhance your wealth-building journey with your most significant asset: your home.

We are committed to ensuring you always have a clear and accurate understanding of your home's value and its impact on your family's financial wellbeing.